If you have posted an Accounts Payable batch to the wrong period, you have a couple of options to correct.

- Void all the transactions via payables and re-enter

- Do a GL journal to account for the expenses

(Just for full information, you could allow a backout of the sub-ledger transaction, but I don't recommend it so will not cover it here).

First off, you will need to find the details of the transactions in the batch. The easiest way is a SmartList.

From the financial transactions default SmartList, choose to include the following columns:

- Originating Master ID (Creditor ID)

- Originating Document Number (Invoice Number)

- Originating Transaction Source (this will be a PMTRN number)

Then search based on the PMTRN full number and the GL lines associated with the batch will show. You can then use this downloaded to Excel to perform one of the following options.

Void the Transactions in Accounts Payable

This is not my preferred option. Chances are, the information for invoice date etc is fine, meaning the supplier will get paid on time and with the correct document references. It is generally a GL impact only.

If you choose this method, you will void the transactions and then need to re-enter them. You will need to re-enter them with a different invoice number, assuming you have the setting ticked to not allow duplicate numbers (highly recommended).

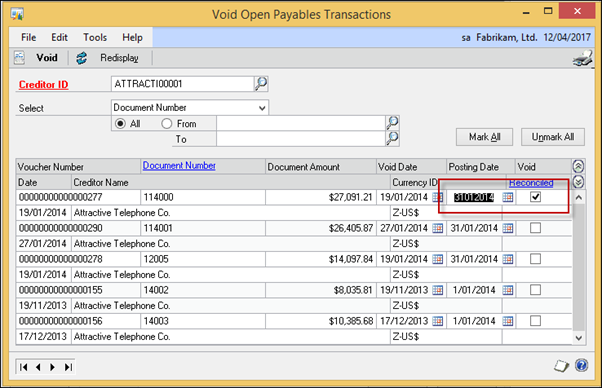

Transactions à Purchasing à Void Open Transactions

Choose the Creditor ID. Tick the document and overwrite the posting date if needed to make sure it is in the same period as the original transaction posting.

Create a Reversing Journal in the General Ledger

This would be my favoured option. It is really only a reporting issue for ensuring you have the expenses in the right period.

Use the download from the SmartList to run a pivot table for the summary movements in the General Ledger.

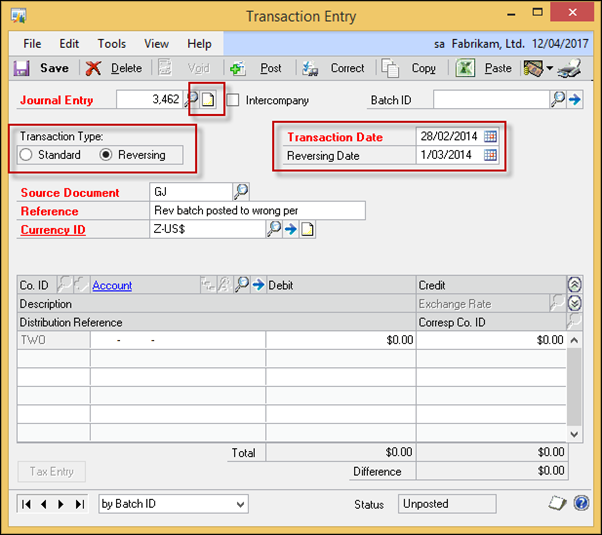

Transactions à Financial à General

Make sure you choose the option for a reversing journal and enter the transaction date and reversing date in the correct period.

You could use the notes area to include a description of why you are doing the journal.

Process the Debits and Credits in the same direction as on your download – they will then do the opposite in the new month, zeroing out the incorrect posting.